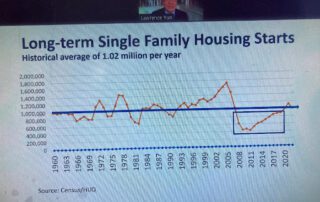

Spring Market. How Much Do You Have to Pay for That House?

This seems to be the number-one question. It is a terrible question based on terrible assumptions: How much over asking price should I offer, on average? Don’t assume that asking prices are based on Fair Market Value. In reality, asking prices are a made-up number intended to get the highest number of offers, so that