What is a Mortgage Discharge and Why Do You Need One?

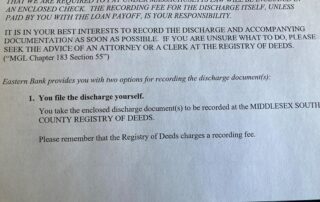

A mortgage is a debt, and an old debt can delay a closing. It almost never happens when there are professionals representing the seller. Once in a while, a seller doesn’t have a thorough attorney or broker. Then a title search will find out that their property still has an open mortgage without a recorded