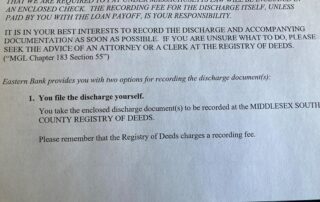

When should I apply for a mortgage pre-approval?

Mortgage pre-approval is needed in order to make an Offer in our area. Anyone without a pre-approval appears disorganized, at best, and is likely to be written off by a seller as not worthy of consideration, at worst. The first question from a seller or seller’s agent about an offer is “How much?” The second