That foreclosure rate dropped like a stone during the pandemic because of Federal protections put in place to keep people from being evicted during the pandemic. One would expect that there would be pent-up additional foreclosures because of that sudden drop. But, that’s not what happened. Instead, rates returned to normal for before the pandemic, not to normal plus additional foreclosures to make up for the ones that didn’t happen in 2020 and 2021. That yields a lower-than-average number of foreclosures over the three years, 2020-2023.

When prices are going up, owners who can sell will sell before they lose their houses. Buyers looking for a foreclosure deal will find that they are thin on the ground.

What is a “foreclosure start”?

When an owner is in default, the lender can begin the process of foreclosure. A homeowner has many ways to delay and stop the process before you will get a chance to buy it.

The first notice is called an “Order of Notice.” This notifies the owner that the lender is exercising its right to foreclose. (Sometimes called “calling in the mortgage.”) A lender can do this anytime a borrower is two or more payments behind.

- Anyone on active duty in the military are protected with the Servicemembers Civil Relief Act (SCRA) *

- Any owner has the right to pay the debt and keep the house up until the auction. It’s called reinstatement.

- Lenders will not accept an offer that is less than their appraiser says is market value.

The Orders of Notice are used to generate pre-foreclosure notices on real estate sites, like Zillow. Frequently, the sites use the term “Lis Pendens,” which means a legal action is being anticipated.

Many of these pre-foreclosures are settled by the owners paying what they owe, so they can keep their house. That is why you see pre-foreclosure listings on public real estate sites show up, then disappear.

What does the rest of the foreclosure process look like, and how long does it take?

The more important notice — the one that really starts things — is the Notice of Sale. The best place to find these is in local papers. Lenders are required to make public notice of foreclosure sales. In that notice, you will get the name of the auction house and the lender. The auctions are frequently postponed a few times.

The more important notice — the one that really starts things — is the Notice of Sale. The best place to find these is in local papers. Lenders are required to make public notice of foreclosure sales. In that notice, you will get the name of the auction house and the lender. The auctions are frequently postponed a few times.

If you attend the auction, you might get a bargain. The cautions are that you may not be able to see the property, you generally have to give up your right to an inspection, and your deposit is non-refundable. But, sometimes, it is worth it.

If the lender is not happy with the results of the auction, they will “buy the paper.” This means that the lender now owns the property.

After the auction, the lender goes about the business of getting the highest possible price for the house. That’s when you see a foreclosed property on the MLS. They hire real estate agents to sell the property.

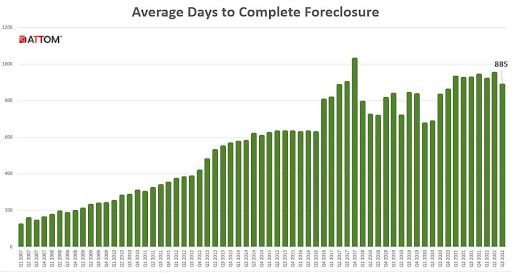

Foreclosure sales take a long time. The current average is 885 days. It has been more than a year, consistently, for the past ten years.

Reading the real estate news

As I watch the real estate news to benefit our clients, I look carefully at how the facts are presented.

If you are seeing news that remarks on the increase in foreclosure starts, remember this:

- Foreclosure starts and actual foreclosures are two different things.

- Foreclosures take, on average, a year or more to hit the market.

- There was a foreclosure moratorium during the pandemic.

The charts from Attom Data are helpful and accurate information. The article that accompanied the charts explains that there is currently no reason to expect a foreclosure boom.

Lenders started the foreclosure process on 67,249 U.S. properties in Q3 2022, up 1 percent from the previous quarter and up 167 percent from a year ago — nearly reaching pre-pandemic levels.

“Foreclosure starts, while rising since the end of the government’s foreclosure moratorium, still lag behind pre-pandemic levels,” said Rick Sharga, executive vice president of market intelligence for ATTOM. “Foreclosure activity is reflecting other aspects of the economy, as unemployment rates continue to be historically low, and mortgage delinquency rates are lower than they were before the COVID-19 outbreak.”

Leave A Comment