Your mortgage contingency allows you to get your deposits back if you don’t get a mortgage. Once that deadline has passed, the seller has the right to keep your deposits if you don’t close on time due to a delay or a cancellation of your mortgage.

Your mortgage contingency allows you to get your deposits back if you don’t get a mortgage. Once that deadline has passed, the seller has the right to keep your deposits if you don’t close on time due to a delay or a cancellation of your mortgage.

Buyers generally have 5-10 percent of their purchase price in escrow at closing. That is way too much money to put at risk!

There are a few things that could happen — last minute — that will stop your mortgage and put your deposits in jeopardy. Many of them are within your control.

General rule: Your income, assets, and credit at the time of your application must be the same at closing.

Income: If you change jobs, give notice to your current job, get fired, or change your position and income at your current employer, let your lender know. In many cases, a change that doesn’t affect your income level will make no difference, if the new job is in a field you are already working in. But you must check. Sometimes there are probationary clauses in your new employment that will prompt the lender to cancel your mortgage.

Also, if you are taking an unpaid leave, and your HR department knows that, it could prompt the lender to discount your income accordingly.

Assets: What you are paying to the lender, attorney, or inspector are not a problem. Your down payment is not a problem. However, large expenses that can wait, should. Even cash ones.

Assets: What you are paying to the lender, attorney, or inspector are not a problem. Your down payment is not a problem. However, large expenses that can wait, should. Even cash ones.

If you have a big expense that you need or want to buy before closing, mention it to your lender before spending that money. Then there are no surprises. If you have adequate reserves, it may be a non-issue. If you have low reserves, it could be.

Credit: The lender verifies your credit score again, just before closing. New credit and increased balances can cause your credit score to go down. This can cause the lender to have to change or cancel your mortgage commitment.

Credit: The lender verifies your credit score again, just before closing. New credit and increased balances can cause your credit score to go down. This can cause the lender to have to change or cancel your mortgage commitment.

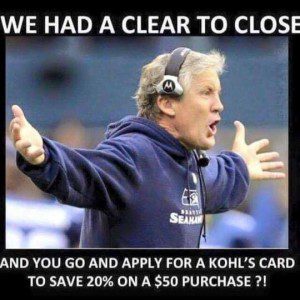

- Do not apply for additional credit (not even a department store credit card!) before closing.

- Do not buy furniture, or a car, or other large items that will leave you with a rotating balance before closing.

- Discuss with your employer, a way to avoid business expenses on your card for the month or two between application and closing. Even though the employer will be reimbursing you, these charges have caused hassles for borrowers.

Leave A Comment