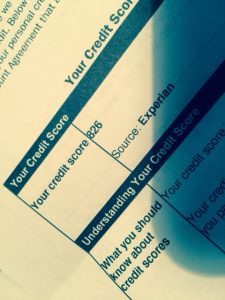

Your credit report is a full list of who you have open credit with, and how loyal you are about repaying those debts. Your credit score is a number compiled based on how you are handling that debt. The algorithm used to determine you credit score changes, but there are some basic rules.

Your credit report is a full list of who you have open credit with, and how loyal you are about repaying those debts. Your credit score is a number compiled based on how you are handling that debt. The algorithm used to determine you credit score changes, but there are some basic rules.

Have open credit lines: The general rule is that you need to have some credit lines open; people who always pay in cash do not have good credit scores. If you never borrow money, how can a lender know if you will pay it back?

When you initially apply for a credit card or a loan, you credit score will go down some. When you have the credit line in place, and you borrow and pay back, you score goes up. This is how credit gets established. You get a credit card with a low limit. You use it and pay it back. Your limit goes up. As time goes one, lenders are more willing to let you borrow more, since you have proven you can borrow and reliably pay back.

Don’t have too much credit: When you open a credit card or an installment loan, the debt is part of the calculation for approving your mortgage. Having a $100,000 limit, in total, on a bunch of credit cards can hurt your credit.

Don’t have too much credit: When you open a credit card or an installment loan, the debt is part of the calculation for approving your mortgage. Having a $100,000 limit, in total, on a bunch of credit cards can hurt your credit.

Your mortgage qualification is based on two ratios. One is the ratio of your income compared to your mortgage payment. The second is the ratio of your income compared to your total monthly debt.

- If you borrowed heavily on a credit card, you could easily mess up your personal finances in a few months. Lenders see that as a potential liability.

- If you already owe $500 a month in installment or credit card debt, it makes it harder to pay your monthly mortgage. That is why lenders look at your total revolving debt when they approve you for a mortgage.

Payment history: If you don’t pay on time, your credit score will go down. The more often you are late paying, the lower it gets.

Leave A Comment