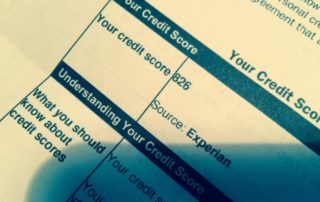

Repair your credit before you look for a house

Do you or someone you know plan to buy a house in the next one to three years? Are you worried that your credit score will increase mortgage costs or even disqualify you for a mortgage? Do you want someone to get you through the credit service red tape? My friend and EBA colleague, Tom