In every market, I run into buyers who do not look at Fair Market Value (FMV) when they decide what a property is worth. That’s a mistake. To negotiate the lowest possible price for a property, a buyer needs a Comparative Market Analysis (CMA) to determine the Fair Market Value (FMV).

Properties sell for what they are worth, most of the time. Properties go up, and sometimes down, in value. A buyer needs to know what a property is worth and whether the market is going up or down. Without that information, a buyer risks paying too much. Or, a buyer risks making offer after offer, and buying nothing.

Skepticism about fair market value is nothing new. When I wrote for The Boston Globe real estate site, I did a chat in March 2009. This is a reprint of that post. Although that was a long time ago, the attitude of the buyers like “Em3” still prevails:

Rona Fischman wrote:

Em3’s comment is from March 30, 2009 chat for Boston.com/renow:*

em3’s comment:

as buyers, we are refusing to pay top dollar for homes that aren’t worth it, (i.e. house needs gut job, rehab, school system is only ok, etc.) What if we see a fair market value as below the 5-20k you mentioned?I answered:

that’s not fair market value, that’s your gut market value. Fair market value means someone else is paying that much for something like what is for sale.

The term for people who will only buy something for less than what it is worth is RENTER.

OK, now that I have the rude joke out of my system…

you may be able to get $5-10K off a fair market value if the seller is in distress. I research the sellers to see if I can find something that indicated distress.

Here’s a longer, and less snarky, answer to a good question:

What is a CMA. What is FMV?

Real estate is a very imperfect market. Perfect, in this sense of the word, means one thing is like another. No two houses are the same. Even when they are first built, little differences in light, lot, and finishes are built in. Then after 10 or 30 or 120 years, rooms have been added, walls knocked down, and repairs done or not done.

So, I agree, there is no single “fair market value” (FMV) established by a Comparative Market Analysis (CMA); it’s usually a range of $5,000 or so. A thoughtful person with the skill to calculate for the imperfectness can get an estimate of what the property should sell for, based on what other people have been spending on properties like it.

As always, the devil is in the details. CMAs are not based on a single house that sold nearby. It involves looking at three or more properties and the market trends. This is a far better way to sell a house then waiting for a buyer to buy based on a gut sense of value (which for a seller is inflated, just as for a buyer it is deflated.) CMA is the best tool we have.

CMAs will indicate what other buyers are paying for houses or condos near and similar to the one that is for sale. Asking prices are very poor indicators of market value. So are municipal assessments and Zillow “zestimates.” But, I will get into that another day.

Back in 2007, when I first wrote about CMAs, I did a quick survey of asking prices and final selling prices. They were, as expected, all over the map. But, in 2007, we were bouncing around the peak of a bubble market.

$419 to $364.5

$449 to $350

$539.9 to $395

$575 to $449

$599 to $430

$529 to $475

$499.9 to $450

$659.6 to $590

$640 to $568

$600 to $570

$789 to $625

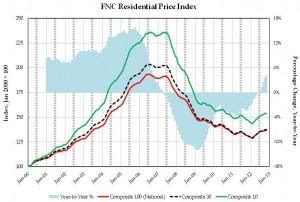

How markets change

In 1995-2006, buyers were paying more than what CMA values were showing. During those years, I frequently found one house selling for $20-30,000 above everything else like it. Some of the time, it was the only one, but rarely as the market heated up. Once there were three houses selling at that level, that higher price is the new FMV, as established by CMA data.

When inventory piles up, sellers lose faith in getting Fair Market Value (FMV) for their property. Some will sell for below the CMA level. That’s a buyer’s market scenario. Just as buyers willingly overpaid CMA levels to drive prices up, sellers will accept less than FMV levels, because they have to sell. This will drive prices down. The trick is knowing how to figure out which sellers can be driven down. Once three sellers do that in a neighborhood, we have deflation in the next CMA there.

Em3, unfortunately, does not speak for all buyers. There are plenty of buyers still paying what he calls “top dollar” for houses that he sees as are not worth it. Although sales volume is generally down, there are a high number of fast sales. What buyers will pay shifts based on supply and demand. In greater Boston, I don’t see a revolutionary boycott by buyers. There are still demand pockets that are making me pull my hair out. Deflation? I’m all for it. I’m a buyer’s agent. It’s just not here yet for me and my towns.

Those of you looking for sellers who will be the first on the block to sell for less than CMA value, do your research and good luck. My buyers and I thank you for your help driving the prices down. I am out there trying to do the same thing.

2021 update: What is happening now?

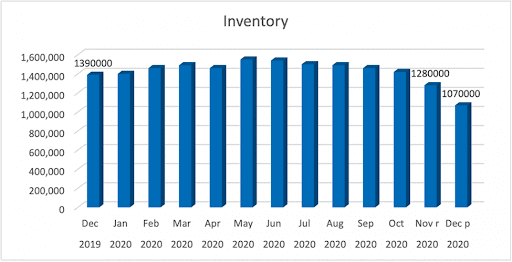

We have a very unequal housing market, in terms of supply and demand.

Supply: We have a housing shortage in eastern Massachusetts. This was made worse by Covid-19. Some people who might want to sell are unable to for these reasons:

- They are unable to find another property to live in. (This was true before 2020 also).

- They are hesitant to allow buyers to tour their home. In normal times, the seller can go out for a few hours and get a meal or see a movie, or something. In Covid-19 times, there are fewer places to go, in order to be away from home while buyers toured. This problem got worse in Massachusetts in winter weather.

- Some sellers are thinking that demand will be even better after the pandemic is over. (I don’t think they are right about that).

Demand: There is a large number of people in the top quarter of the economic ladder who switched to work-for-home options, or stayed employed in essential jobs. Their income did not get affected. Their problem was not with money but with space.

They struggled to provide daycare for minor children who were not in school or preschool. If they worked at home, they juggled; if they worked away from home, they needed to hire or recruit another adult to keep their children safe.

This group of people realized that work-from-home may be an option that will last beyond Covid-19. They spent March-April-May getting very clear on how much more living space they want, then set out to buy it last summer. They increased the demand for houses for sale.

What to expect in 2021?

The supply and demand problem in eastern Massachusetts is not going to go away anytime soon. That is why you need to know what the Fair Market Value of a house is, before you face a bidding war. You are unlikely to buy a house without competition, so be prepared!

Link to additional data about the national real estate inventory shortage.

*all links from Boston.com/renow have been removed in a revamping of that site. I wrote for this Boston Globe real estate site from 2007-2012.

Leave A Comment